For those who’ve been in the financial reporting game, this familiar number is your last performance’s curtain call, carried forward as the opening act for the new period. If this is your debut statement, then you’re starting from scratch—your opening balance is zero. Remember, your beginning balance isn’t just an arbitrary number; it embodies the company’s cumulative earnings minus cumulative dividends since day one. Think of it as a financial saga that sets the stage for the current period’s financial storytelling. To kick things off with preparing a statement of retained earnings, you start with a sprint down memory lane – the beginning balance. This figure is the retained earnings you reported at the end of the previous period and serves as the launching pad for the current period’s calculations.

Company Life Cycle

Also, retained earnings at the beginning of the same year were $ 70,000. The statement of retained earnings is also called a statement of shareholders’ equity or a statement of owner’s equity. The income statement and cash flow statement are linked through net income, which serves as the starting point for cash flow from operating activities. Revenue growth is one of the most fundamental assumptions in financial projections, as it influences other forecast components like expenses, profit margins, and cash flow. Paying the dividends in cash causes cash outflow, which we note in the accounts and books as net reductions. They want to know about the returns generated by retained earnings.

Impact from Dividends

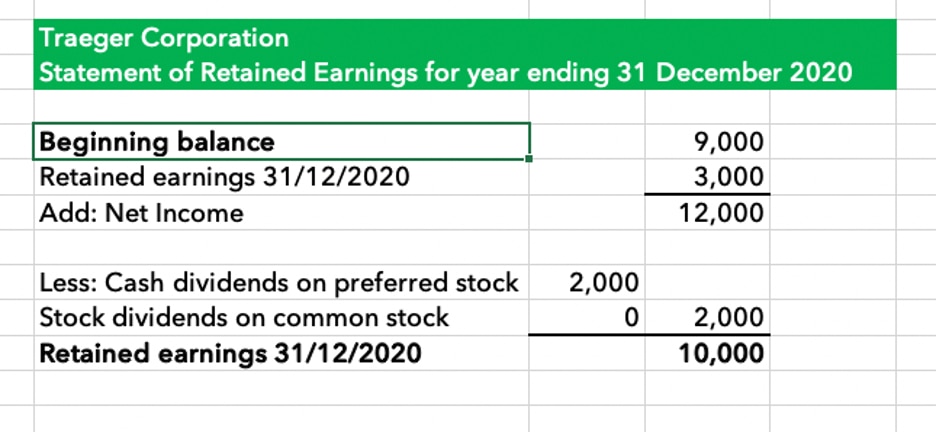

To calculate Retained Earnings, the beginning Retained Earnings balance is added to the net income or loss and then dividend payouts are subtracted. Net income is like the heartbeat of your company’s financial health, pulsating through the veins of your statement of retained earnings. Think of it as the hard-earned result of your business operations—the grand total after expenses bow out of revenues’ spotlight. The statement of retained earnings (retained deductions for sales tax earnings statement) is a financial statement that outlines the changes in retained earnings for a company over a specified period. This statement reconciles the beginning and ending retained earnings for the period, using information such as net income from the other financial statements. The retained earnings (or retention) ratio refers to the amount of earnings retained by the company compared to the amount paid to shareholders in dividends.

- Now, their collective impact crystallizes into one defining number—your ending retained earnings.

- The below snapshot shows the Consolidated shareholder’s equity statement for Apple Inc. for the year ended 2018.

- A statement of retained earnings, or a retained earnings statement, is a short but crucial financial statement.

- Retained earnings reflect the cumulative amount of net income a company has retained over time, after distributing dividends.

What Is the Relationship Between Dividends and Retained Earnings?

This statement details the company’s revenue, expenses, and net income over a specific period, providing insights into its profitability. The statement of retained earnings is a financial statement that is prepared to reconcile the beginning and ending retained earnings balances. Retained earnings are the profits or net income that a company chooses to keep rather than distribute it to the shareholders. Cash flow modeling is a critical component of financial statement modeling, particularly for businesses reliant on accurate cash management.

You can use them to further develop your business, pay future dividends, cover any debt, and more. Before you make any conclusions, understand that you may work in a mature organisation. Shareholders and management might not see opportunities in the market that can give them high returns. For that reason, they may decide to make stock or cash dividend payments. Retained earnings result from accumulated profits and the given reporting year. Meanwhile, net profit represents the money the company gained in the specific reporting period.

Retained earnings are important for the assessment of the financial health of a company. That net income lets the company distribute money to shareholders or use it to invest in its own growth. Retained earnings for a single period can reveal trends in the company’s reinvestment, but they don’t tell you how those funds are used, or what the return on investment is.

The use of Brex’s platform is subject to eligibility requirements and terms of service, learn more at Brex.com/legal. Service-specific terms apply, including but not limited to our Brex Card Program Terms, Rewards Terms and Travel Terms. Offers contingent on using Brex services are subject to qualifying for those services. That amount is added to the original $100,000 for a new total retained earnings of $130,000. Note that “Dividends” include all types of dividends, including stock issuances. Retained earnings often enjoy a reputation as a marker of a company’s wealth, but grab your myth-busting gear because it’s not quite the financial fortress it’s rumored to be.

In studying “Financial Statement Modeling” for the CFA, you should learn to construct and analyze financial models that integrate income statements, balance sheets, and cash flow statements. Understand the forecasting techniques for projecting revenues, expenses, capital expenditures, and working capital requirements. Analyze how assumptions on growth rates, margins, and key financial ratios impact a company’s financial outlook and valuation. Evaluate the interdependence of financial statements to ensure consistency and accuracy in modeling. Additionally, practice scenario and sensitivity analysis to assess the impact of different variables on financial outcomes, aiding in investment decision-making and risk assessment. The statement of retained earnings is one of four main financial statements, along with the balance sheet, income statement, and statement of cash flows.